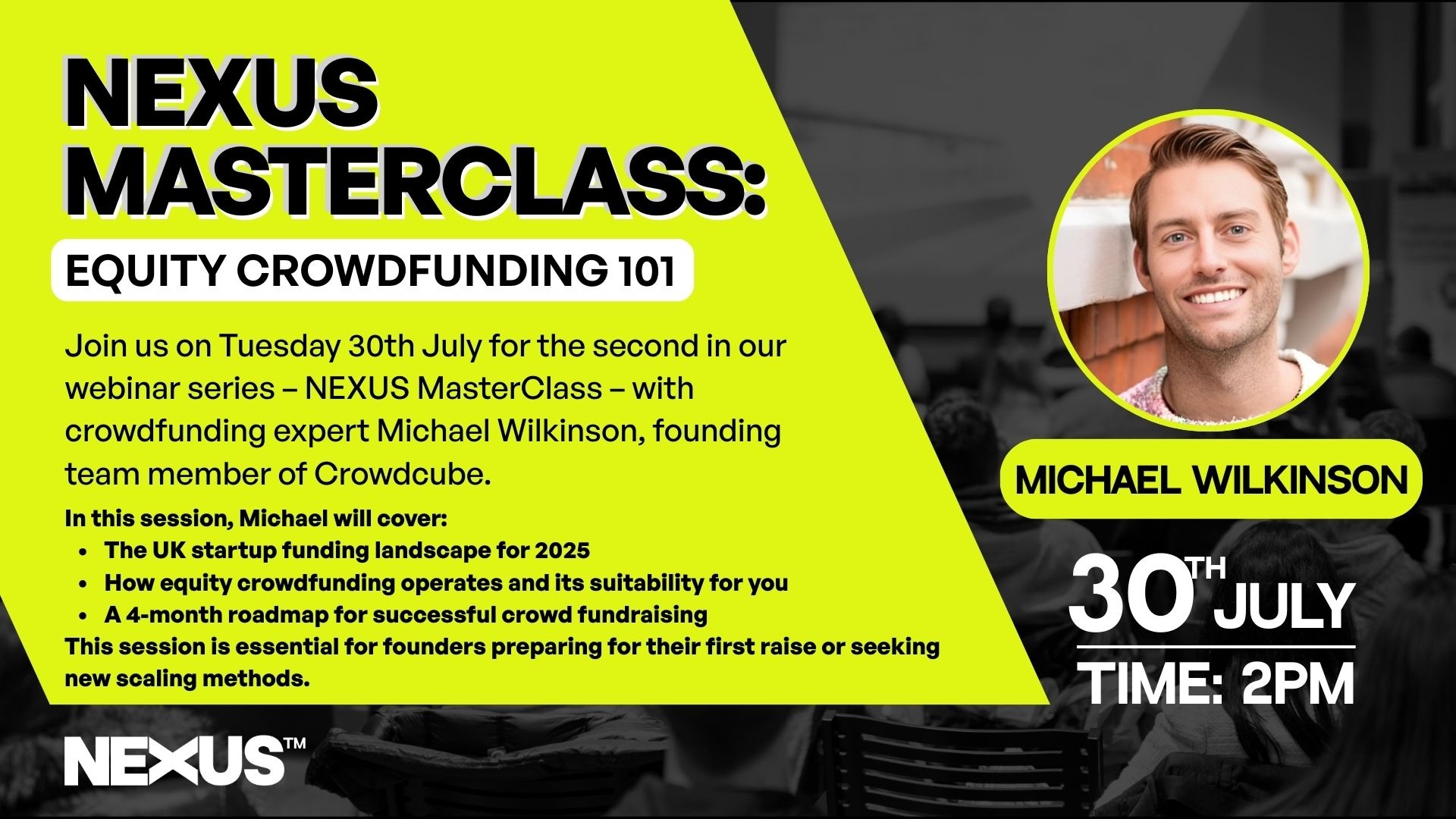

At our latest NEXUS Masterclass, we welcomed Michael Wilkinson, former Commercial & Operations Director at Crowdcube, Europe’s leading equity crowdfunding platform. With over eight years at Crowdcube, Michael has supported more than 1,300 startups to raise £1.4 billion in funding, working with brands such as Monzo, Revolut, FreeTrade, Citymapper, and BrewDog.

In this in-depth session, Michael shared his step-by-step guide to equity crowdfunding, giving founders a realistic picture of the process — from preparation to launch, to investor relations post-campaign. He also offered his “warts and all” perspective on why only 40% of crowdfunding campaigns succeed, and the six critical factors every founder must have in place before going live.

Key Takeaways from the Masterclass

- Where equity crowdfunding fits in the funding ladder compared to angels, VCs, and grants.

- The biggest benefits for startups: raising investment capital, building community loyalty, and generating free PR.

- The risks and challenges founders need to prepare for, including timelines, costs, and failure rates.

- Real-world case studies from Monzo, FreeTrade, and Skin Analytics.

- A six-month roadmap to prepare, launch, and run a successful campaign.

- The “six ticks” framework to assess whether crowdfunding is the right option for your business.

Michael also stressed that consumer-facing startups (B2C) often see the best results, while more complex B2B or deep-tech companies may be better suited to angels, VCs, or grants.

Why Equity Crowdfunding Matters for Founders

For early-stage startups, equity crowdfunding is more than just raising capital. It’s a powerful way to turn customers into brand advocates, strengthen community engagement, and validate your business model in front of a wider audience. Done right, it can open doors to future angel and VC investment, while also generating long-term brand loyalty.

If you’re considering raising investment through equity crowdfunding, this masterclass provides practical strategies, proven insights, and honest lessons to help you decide whether it’s the right funding route for your business.